Buy Property in Melbourne

Why buying property in Melbourne?

Investing in Melbourne, particularly in residential property brings investor attractive potential return. The reasons are:

-

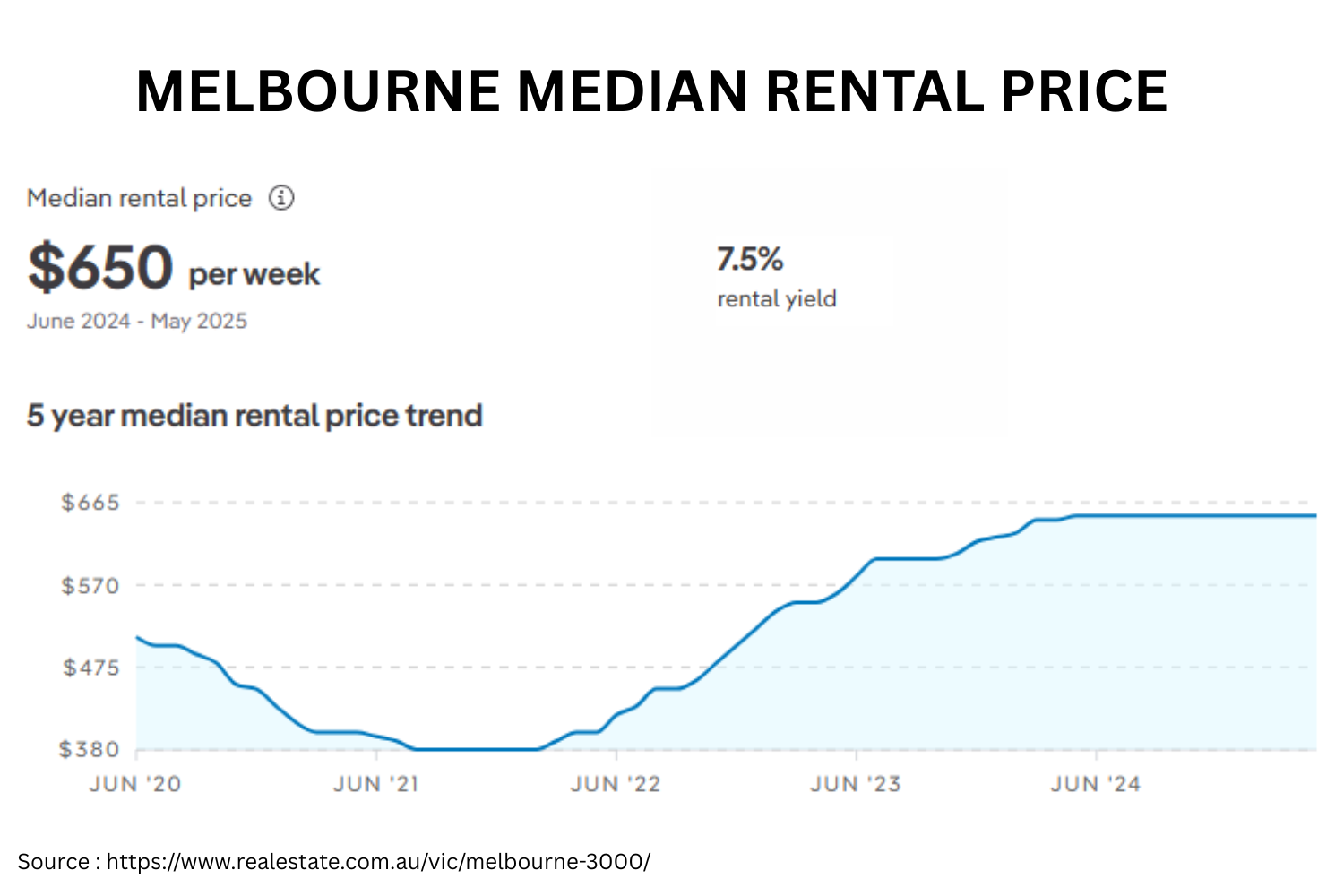

Melbourne has a high rental growth. In 2023, average rental price grew 15.2% YoY.

-

Melbourne has a strong population growth momentum, fueled by international migration and students.

-

By 2023, Melbourne’s population is already the biggest among other capital cities in Australia.

-

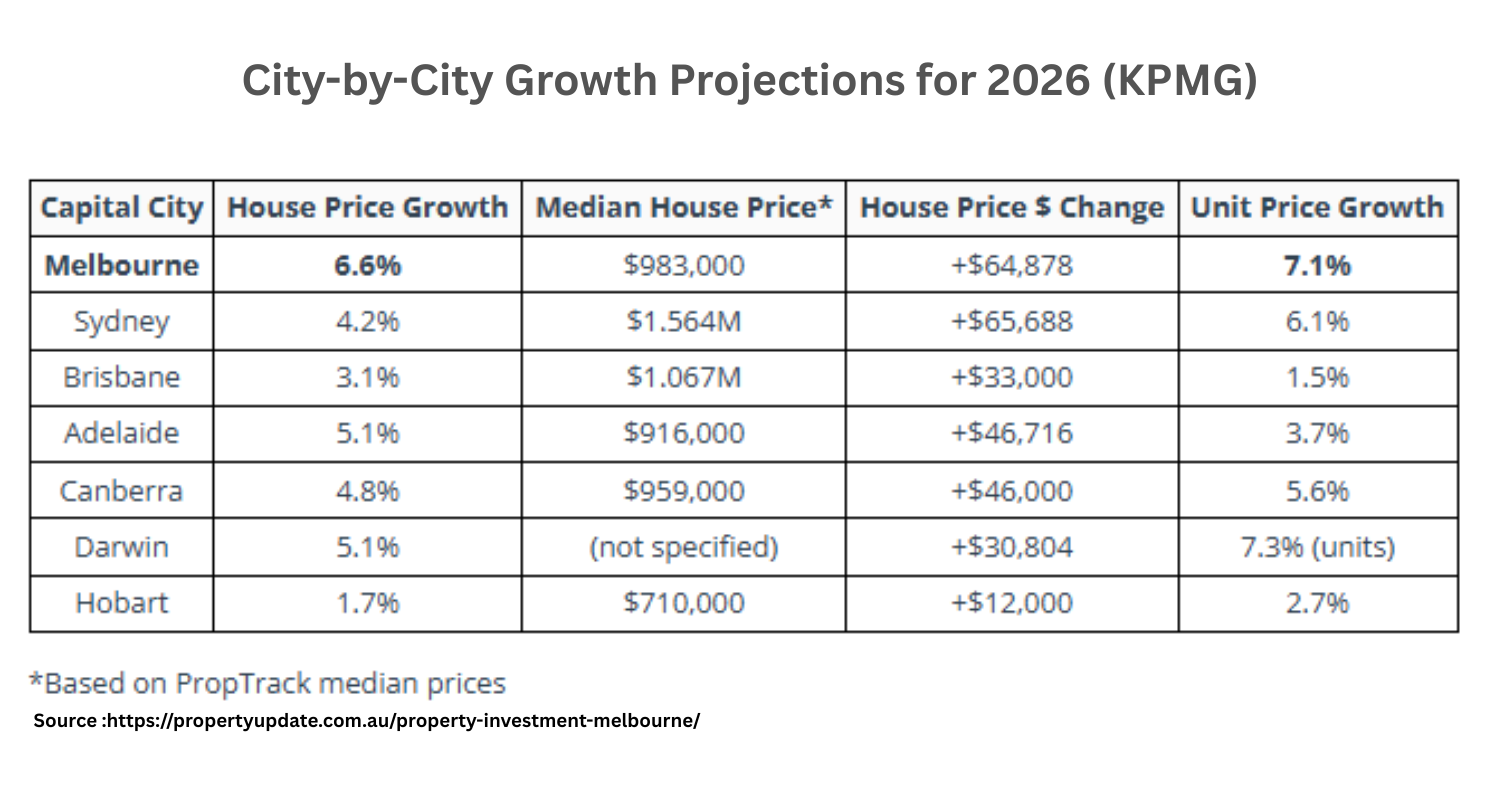

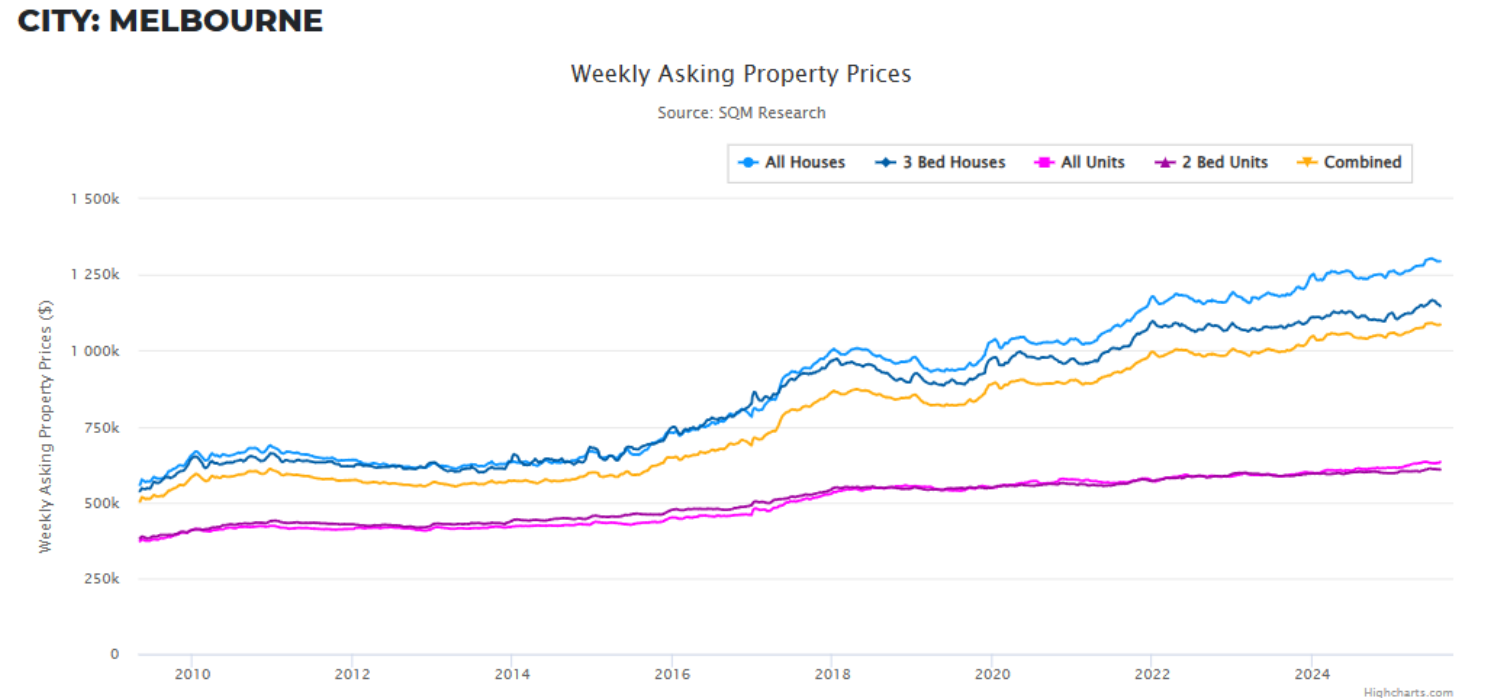

Reported by JLL Australia, Melbourne Apartment cycle just started its upward momentum.

Facts in residential occupancy:

-

Demand for rental property has continue to grow since 2008, pushing the price up and keeping the vacancy rate at a low level.

-

Shortage of a new housing stock has increased rental price and property price increased rapidly.

-

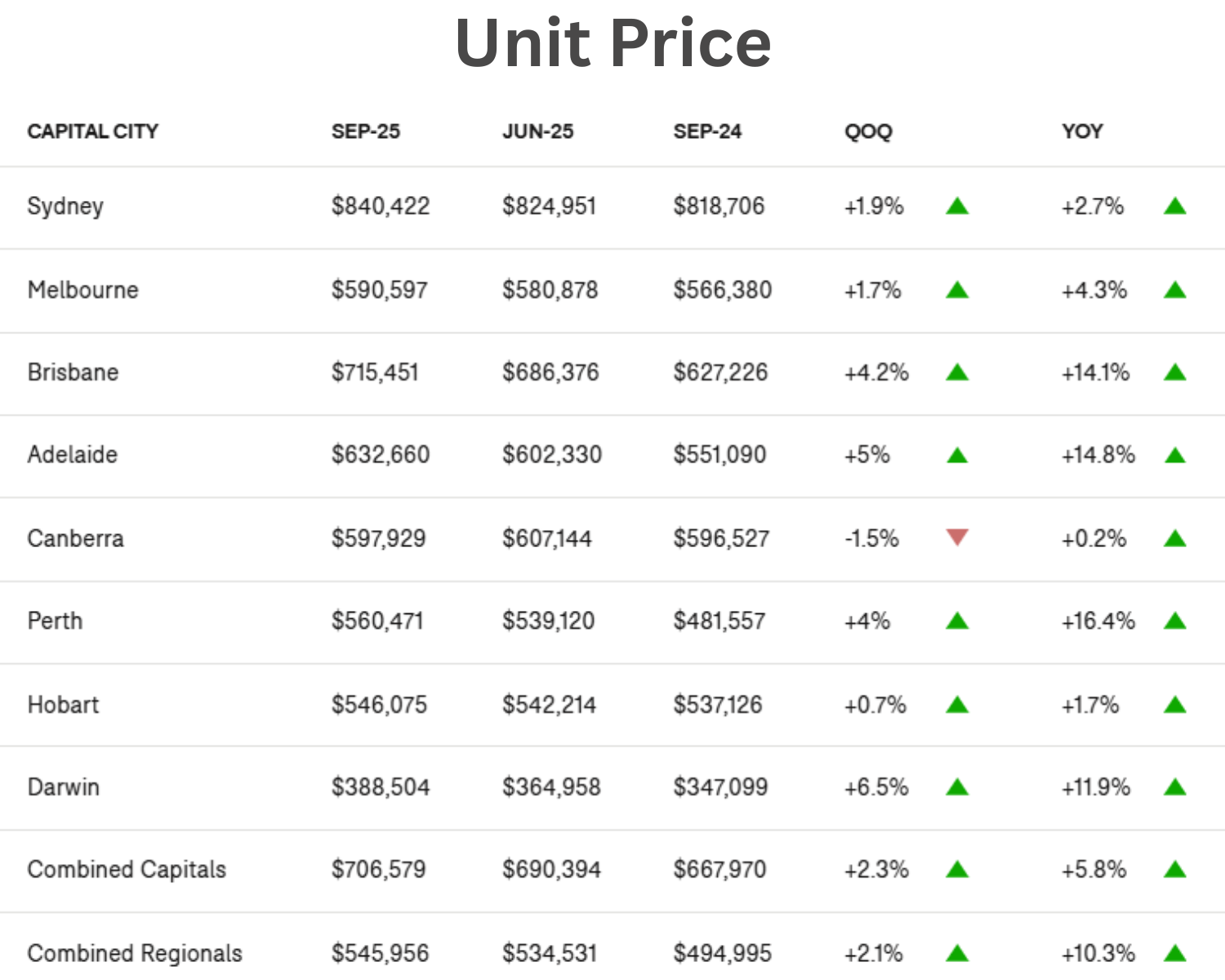

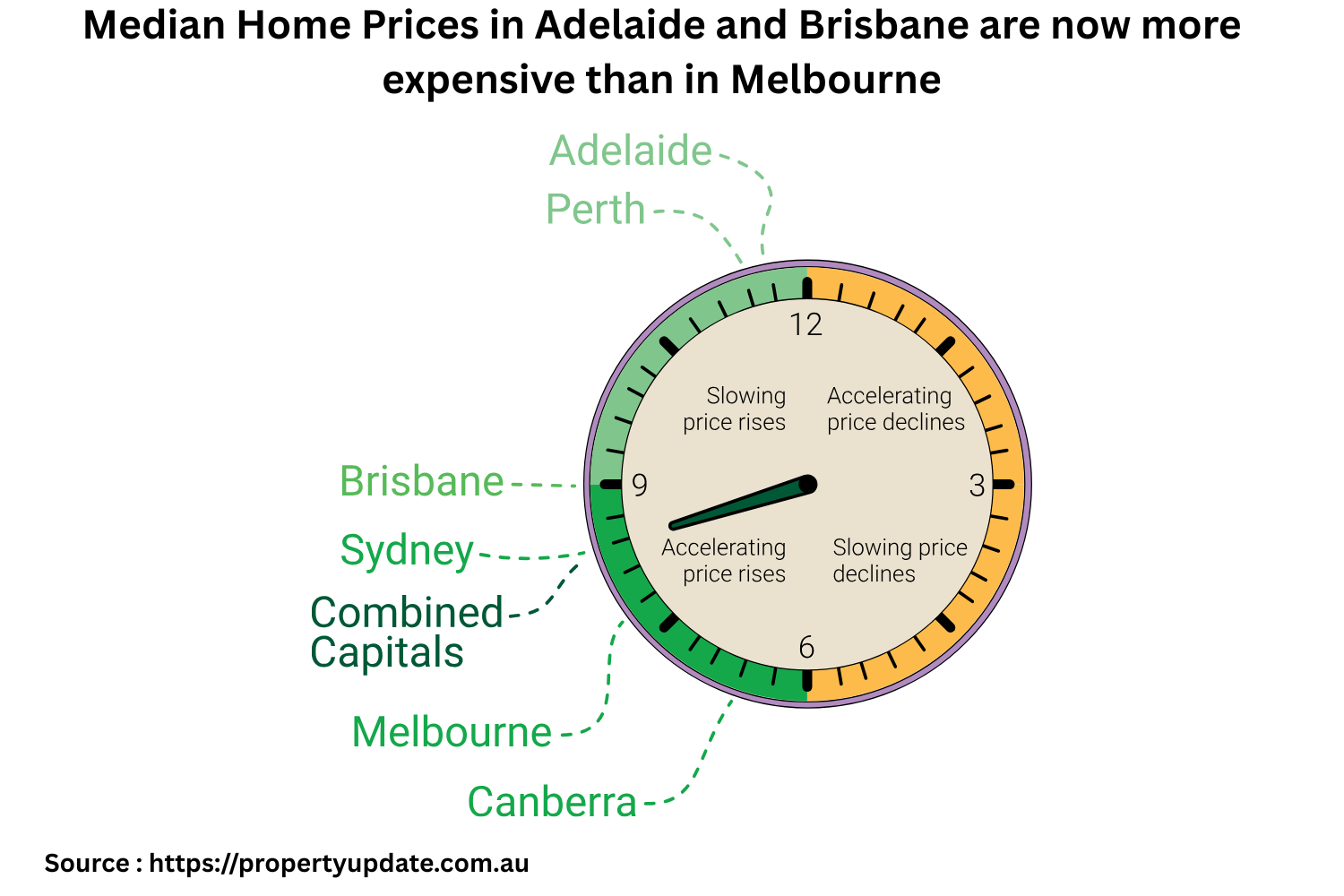

Melbourne is still one of the most affordable apartment markets in Australia. And the incentives given by the government for first home buyers has boosted the interest in Melbourne’s property market.

-

Having a strong property record for over 30 years has made Australia the country that provide attractive gains for property investment.

-

With the constant turmoil and conflict in Europe, Australia is a safe and stable place for securing investment.

-

Australia has a clear property law and low risk in the process of buying a property, where the process is easy, efficient, easy, open and transparent.

-

The price of property in Melbourne, especially apartments is stable and tend to increase.

.png)

.png)

.png)